SA franchising opportunities

South Africa can expect the franchise industry to continue to provide solid growth in the future, says Gerrie van Biljon, executive director of Business Partners (BUSINESS/PARTNERS).

South Africa can expect the franchise industry to continue to provide solid growth in the future, says Gerrie van Biljon, executive director of Business Partners (BUSINESS/PARTNERS).

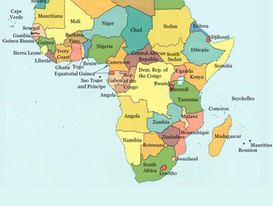

There is one trading partner of Africa’s that holds the key to the continent realizing consistent, sustainable economic growth in all of its regions and across a wide range of economic sectors. This partner is not India, Europe or the U.S. It is not China.

Since early Q3 2014 the oil price has halved from a then $90/barrel to less than $45/barrel and more recently, the price has drifted back to over $50 per barrel. Of course the world is trying to figure out what the impact will be on consumers and businesses, and what does this mean for South Africa?

Muhammadu Buhari will be Nigeria’s next president. Mr Buhari won 15,424,683 votes to 12,853,162 for his opponent, President Goodluck Jonathan – a wide margin of roughly 54% to 45%. Mr Jonathan graciously called his victorious challenger on the telephone to concede and to congratulate him on the evening of Tuesday, March 31, when only the results from Borno State still had to be announced.

The bull market in South Africa has been going for over six years and investment managers now need to moderate their risk in anticipation of a potential bear market on the horizon, says Rob Spanjaard, Rezco Asset Management CIO.

On Saturday, March 21, Namibia embarks on a fresh course that seems set to boost the country. The date marks Independence Day – it will be exactly 25 years after Namibia lowered the apartheid flag over its territory and ushered in change that would ultimately impact the entire region and help end racial domination in South Africa.

Fitch Ratings affirmed Zambia’s sovereign credit risk rating in a report dated March 13, although the outlook was revised due to policy coherence and credibility concerns. Fitch affirmed Zambia’s long-term foreign and local currency Issuer Default Ratings (IDRs) and senior unsecured foreign and local currency bonds at “B”, while the outlook on the IDRs was revised from positive to stable. The revision captures Fitch’s view that policy coherence and credibility “are weak and a growing constraint on the rating”.

Godfrey Kiiza of KPMG Rwanda explores the benefits that Rwanda stands to gain if it develops its treasury and bonds trading.

It’s no secret that sub-Saharan Africa has seen significant growth over the last decade. There may have been bumps on the road, but the trend is set to continue. The US private equity group, Carlyle is a case in point. In April of last year it closed its maiden private equity fund focussed on sub-Saharan Africa at nearly $700m, 40% above target. Last November, it announced its first investment in Nigeria, taking an 18% stake in Diamond Bank. And, the same week saw another first for Carlyle, this time in South Africa, where it acquired TiAuto in a deal thought to be worth about $182m.

Although the recent experience in Nigeria is a reminder that the high rewards investors seek in Africa tend to be accompanied by elevated levels of risk, the long-term outlook for African markets remains positive, says Johan Steyn, Portfolio Manager at Prescient Investment Management.

China’s investment in African resources remains at a relatively early stage and is likely to increase further over the next decade, despite the economic slowdown being experienced in the world’s second largest economy, says George Fang, Standard Bank’s Beijing-based Head of Mining and Metals in Asia.

Musa Manyathi, Director of International Tax at Deloitte South Africa, explores the tax related challenges that South African companies face when looking to invest into the African continent.

Simon Freemantle, Senior Political Economist at Standard Bank, comments on the landscape for African elections in 2015.

The reintroduction of capital gains tax (CGT) faced severe criticism, with many analysts indicating it could impact investment in equities and the real estate, oil and mining sectors, says Michael Kimondo, Head of Treasury Operations at Fusion Group.