South Africa’s Asset Management Industry Grows 9.5%

Word count: 447

South Africa’s asset management industry assets grew by 9.5% supported by strong domestic markets, according to the 27four DEInvest Annual Survey 2025.

South Africa’s asset management industry assets grew by 9.5% supported by strong domestic markets, according to the 27four DEInvest Annual Survey 2025.

The findings reveal a sector expanding in scale, deepening in transformation and redefining how capital is deployed for both return and impact.

Drawing on data from 93 asset managers overseeing R6.83 trn in assets and employing more than 5 400 professionals, the survey captures an industry at a turning point.

Consolidation, inclusion and innovation are reshaping South Africa’s investment landscape and setting the tone for its next phase of growth.

Although large firms still dominate, a dynamic layer of mid-sized and emerging managers is driving competition, innovation and diversity across the system.

Private markets are gaining prominence, with allocations to private equity, infrastructure and private credit now among the top five strategies by assets. This marks a decisive shift towards long-term investment in productive sectors of the economy and a growing recognition of private markets as catalysts for sustainable growth.

Transformation remains a hallmark of the industry:71% of firms are Level 1 B-BBEE rated, 74% are majority black-owned and women now represent 52% of the workforce. Progress is evident, but the under-representation of women in senior investment and leadership roles remains an area of focus.

Corporate activity has accelerated. Landmark transactions involving Sanlam and Ninety One, Coronation Fund Managers and the merger between Vunani and Sentio have reshaped the market and heightened the drive for scale and competitiveness.

The introduction of Actively Managed Exchange Traded Funds on the JSE and continued fee compression demonstrate a market that is evolving rapidly and aligning with global developments.

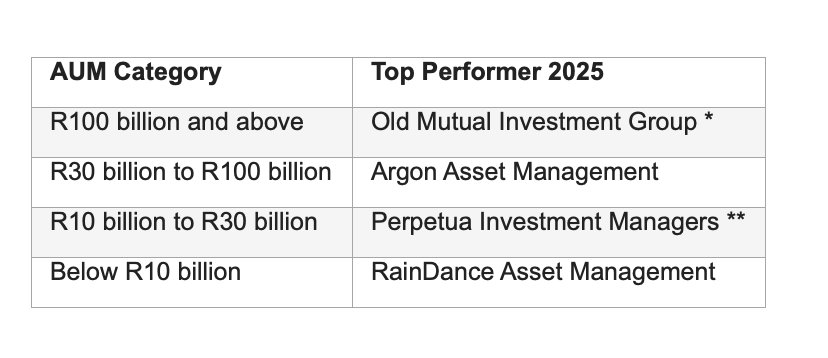

2025 DEI Index results

The 27four DEI Index, now in its second year, recognises asset managers that are leading the industry in ownership, representation, equity, impact and governance.

*Old Mutual Investment Group retains its position at the top for the second consecutive year.

**Perpetua Investment Managers also wins its category for the second year in a row, underscoring its continued leadership in advancing diversity and inclusion.

The median DEI Index score rose to 49 % from 46 % in 2024, reflecting measurable progress across the sector. Smaller firms continue to prove that intent and culture, rather than size, determine the depth of transformation.

Fatima Vawda, Chief Executive Officer of 27four, said the results confirm that the industry is maturing in both performance and purpose. “Transformation has taken root, but inclusion must now translate into impact. The next phase for our industry is not just about who is represented, but who has a voice, who shapes capital allocation and who benefits from growth. Progress must be felt, not just measured,” she said.